CARD LIMITED, LLC

Business Intelligence research uncovers $2,000,000 in recoverable assets and customer valuations worth 4-5x original value.

Business Intelligence research uncovers $2,000,000 in recoverable assets and customer valuations worth 4-5x original value.

BI Oracle project for Card Limited, LLC. Project involved a deep dive into new databases unfamiliar to the client, identifying suspected fraudulent behavior, and providing a Lifetime Value estimation for legitimate consumers based on certain behaviors.

At the end of the project we had identified nearly $2,000,000 in potentially recoverable assets and identified consumer behaviors that predicted to values 4-5x the median consumer value.

In early 2015 Card Limited approached us with a problem. They had recently acquired a new prepaid debit card portfolio. The portfolio had solid bottom line numbers and performance that made it an attractive acquisition, but the previous owners had not provided any detailed data regarding customer value and performance.

A few months after acquiring the portfolio they realized that there was the potential for a sizeable, unidentified population of fraudulent users. They had three questions:

The client had received their data in a number of formats, including several Excel files, text files, and a MySQL database from the credit card processor. Data definitions were not present. My first step was to consolidate the different data sources, clean the data, and ensure that I had keys to match user accounts to transactions, transactions to merchant categories, and both to geographic locations.

After a data cleaning process, I built a database using Amazon’s Web Services RDS and uploaded the now clean data to it. I then use Tableau Desktop on top of the newly built RDS instance to explore and visualize the data.

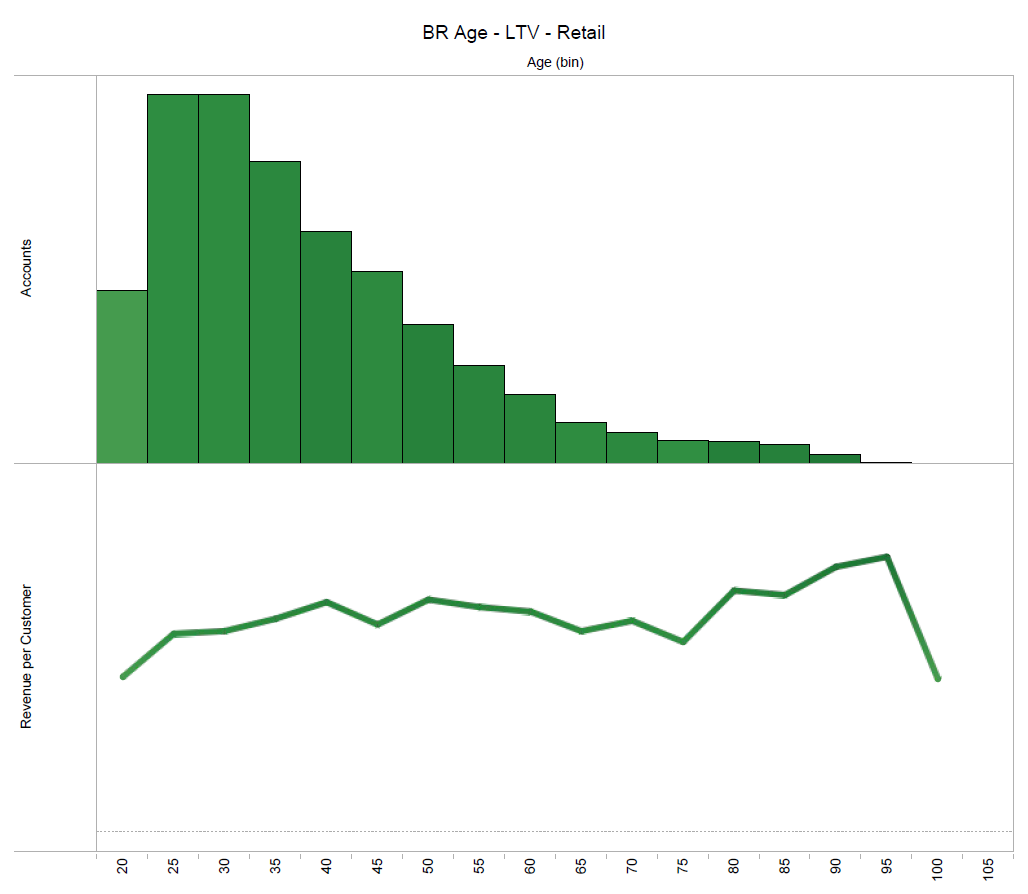

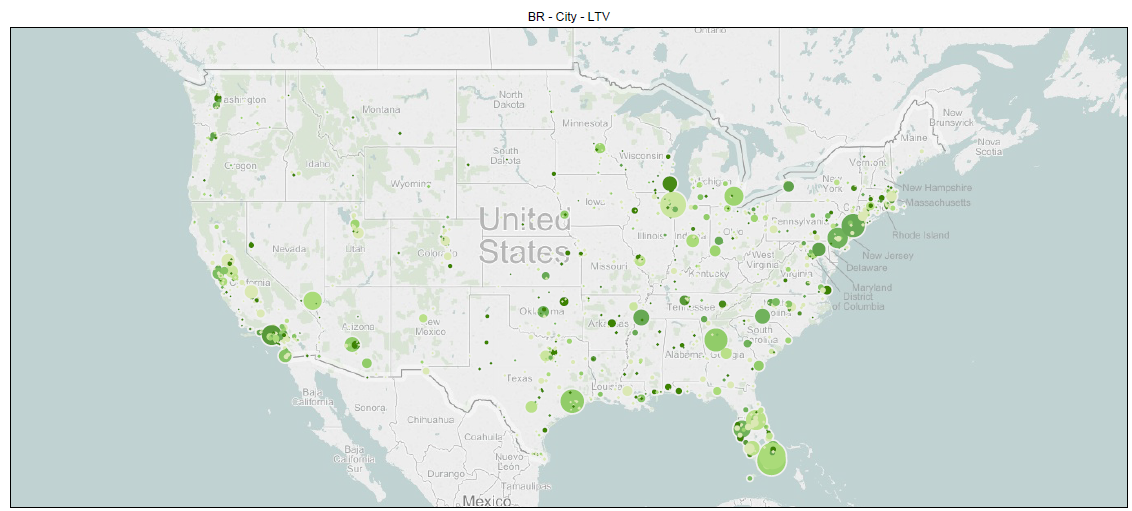

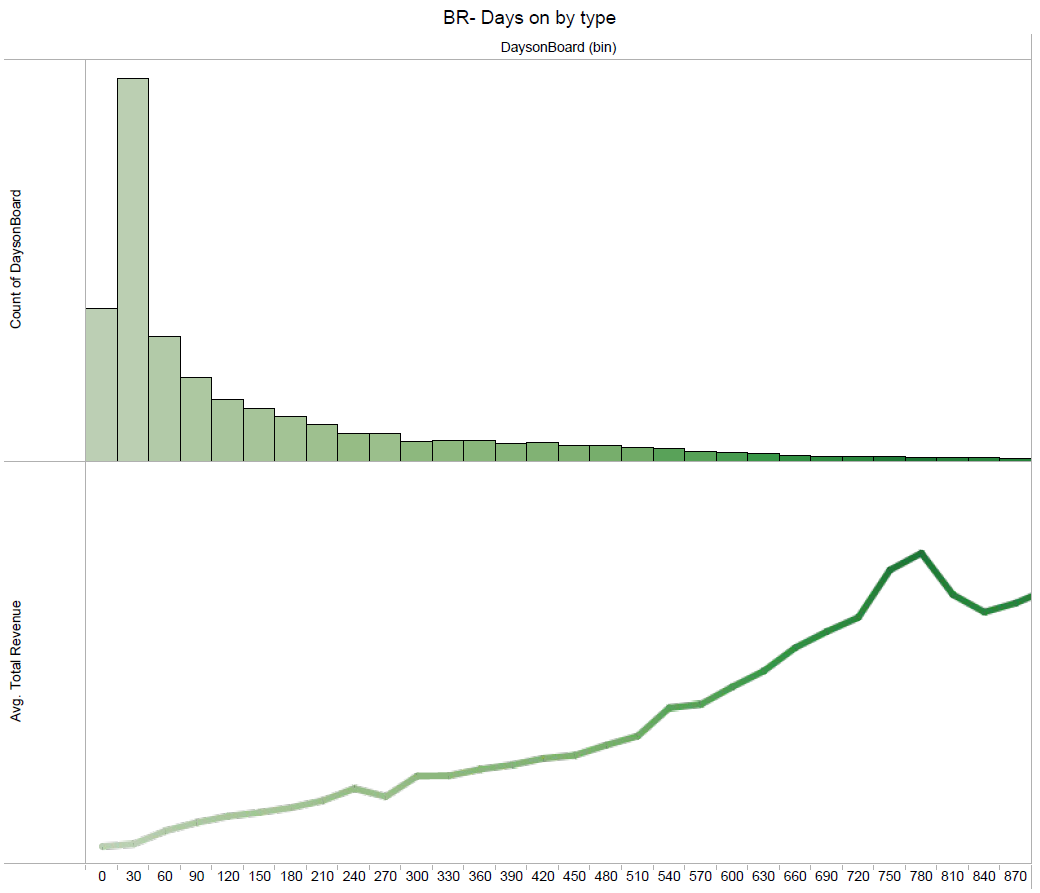

Using Tableau I was able to cluster lower-value predicting behaviors and fraudulent-predicting behaviors.

Segmentation was rules-based and seemed to be largely predictive of value. Several key behaviors were identified that would allow Card to identify both fraudulent and higher value users.

Card was able to use my findings to flag nearly $2,000,000 in potentially recoverable assets from fraudulent deposits. They were also able to build out marketing personas of higher value users that would go on to inform their overall business strategy.